I don’t have a SSRN like those cool academic types, but I wrote this review of Hanna Wilberg’s new textbook Administrative Law in Aotearoa New Zealand for Public Law Review. Since my draft post about the Law Commission’s 2026-2028 Work Programme hasn’t gotten much further than “judithal review”, I’m bunging it up here. I’ve removed the footnotes of cases and pinpoints in the text as footnotes don’t really work in a blog post. I kept one that I thought was mildly entertaining. You’ll just have to trust me for the rest.

Anyway, the book is Good and you should buy it, I reckon. Currently paperback for only $89!

—

Ask someone knowledgeable about modern administrative law in Aotearoa New Zealand and they might describe it to you as contextual and non-doctrinal. Ask a slogger in the profession like me,[1] and they’ll tell you those are euphemisms for changeable and slippery. We probably never had a stable Diplockian CCSU-type golden age of administrative law, but we are certainly now at new frontiers. There is a large‑scale project to account for tikanga Māori in our legal system, with administrative law cases often the laboratory for development. Our higher courts decline to articulate any theory for standard of review, to the point the profession has stopped asking. And the Supreme Court recently used the principle of legality to read down primary legislation – enraging half the commentariat and leaving the other half wondering what the rules about doing that are exactly.

Against that background, a new text on administrative law has never been harder to write, nor more needed. And, if it is to be any good, it has to be about now and the future – not just a tabulation of what has come before.

Hanna Wilberg’s Administrative Law in Aotearoa New Zealand is timely, vibrant and masterful. Timely because it is an up-to-the-minute account of a field that is requiring its adherents to run to keep up. Vibrant because it hums with modern New Zealand administrative law scholarship in ways that are both heartening and exciting. And masterful because Wilberg’s explanations and synthesis of the topic equips readers with what they need to know today and tomorrow.

Wilberg defines administrative law as “the law that governs public administration”. She explains that judicial review cases are the major source of our law and norms in that regard, not just for litigators but for public servants and decision-makers too. This allows the text to centre judicial review, but never to the exclusion of other important sources of administrative law – things like the Regulations Review Committee or the Ombudsman. She also makes the point that any subject area is going to bring with it is own norms and substantive law together with judicial review. The result is an account of administrative law that has a focus on judicial review, but not an obsession. It gives a compelling account of the law of judicial review without ever suggesting that is all an administrative lawyer needs to know.

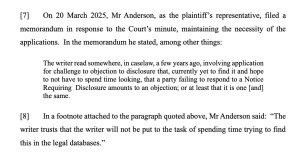

That approach also positions the text extremely well in the New Zealand market. The latest edition of Joseph on Constitutional and Administrative Law is now over 1500 pages because it needs to do everything: constitutional and administrative law. Taylor’s Judicial Review: A New Zealand Perspective is primarily judicial review but is more at home with the second Cooke J than the third. And Smith’s Judicial Review Handbook (a New Zealand equivalent of Fordham) is a useful reference for litigators but does not itself offer any account of the subject beyond its chapter taxonomy and the judgement inherent in its selection or non-selection of cases. Wilberg’s work gives something that each does not: concision, modernity, and explanation. Each of those qualities is on full display throughout.

To the nuts and bolts then. The text has fifteen chapters divided into five parts.

Part One is an introduction and overview. Chapter 3 is called “Introducing Debates: The Role of Political Values and Constitutional Principles” and is the chapter which is a fulcrum on which a lot of the substantive analysis in the later chapters turns. This is not a book about theory but chapter 3 takes the time to sketch out red light and green light theories, political underpinnings, and four constitutional principles – democracy, the rule of law, parliamentary sovereignty and separation of powers. The accounts of all of these are straightforward and accessible. That is not to damn them with faint praise but the pay-off for them is really in the chapters that follow.

Part Two comprises chapters on judicial review grounds proper. There are four chapters. Three of them are familiar to Lord Diplock – procedural fairness, illegality and unreasonableness. The fourth is described as “Modern Extensions: Rights as Grounds of Review” and looks at judicial review in respect of Te Tiriti o Waitangi, international law, fundamental common law rights, and the New Zealand Bill of Rights Act 1990. Wilberg describes review on rights grounds as “one of the major areas of expansion in modern judicial review”. There is no doubt that reflects modern legal practice and the text’s taxonomy reinforces its usefulness.

Part Three is about the limits of judicial review: when it is and is not available (both in terms of justiciability and privative clauses); ways of calibrating restraint in review; and remedies. It addresses collateral challenge as part of remedy. The restraint chapter – Chapter 9 – is probably where Wilberg roams the furthest from modern New Zealand position. Drawing on Craig, Taggart and Knight, as well as much of her own previous scholarship she maps the case for why courts might not always adopt a correctness standard for questions of law (think Chevron and the chopping and changing Canadian Supreme Court approaches of the last 20 years). Wilberg is not evangelical on the topic but you get the sense she is laying out a set of tools for people to use when the time comes to make those arguments. Whether New Zealand courts will be so amenable is a different question.

Part Four is about public and private. Its first chapter addresses the public/private divide and the reviewability of things like commercial decisions by the state. Its second chapter examines public authorities’ liability for damages both in tort and in damages for breach of the Bill of Rights Act.

The fifth and final part is about administrative justice, about which more later.

Each chapter is divided into topics and within each topic Wilberg gives a short introductory sketch, then sets out a series of subheadings that move through the topic starting with the description and then addressing areas of contention or debate. That rather bland description by me does not do justice to Wilberg’s skill in doing this – consistently and well – chapter by chapter. Taking the reader through the orthodoxies and introducing and explaining debates is what a textbook is for, but Wilberg is a strong writer and a great explainer and you love to see it done well. That work also pays off the groundwork of the theory from Chapter Three. Wilberg frequently refers back to it in order to explain that debates on the substantive law are often a result of tension between competing principles. In this way we get more than mere description of debates but never in a way that gets bogged down reintroducing the theory each time.

The text also balances authority and intellectual modesty. We see Wilberg disagree with Joseph on whether a decision-maker may have an additional improper purpose; we get her view that predetermination is simply one of the forms of apparent bias and that the test in Saxmere should apply to them all; and we get her take on Fitzgerald where her careful dissection of the judgments asks us all to calm down (which I will not). For some topics she draws on her previous scholarship – such as mistake of fact – to strong effect. But those parts never feel unbalanced or self-indulgent. Equally, there are some topics where Wilberg is content to explain the debate but leave it unresolved rather than pretend to have the answer to everything. Rather than feeling shortchanged, that approach caused me to take Wilberg’s analysis all the more seriously.

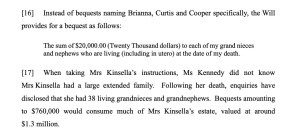

It is hard to convey just how modern it all feels. Often when Wilberg makes her points, she is speaking the same administrative law language as our courts do today. It is a search for context and justification, and the eschewing of hard rules. Where divides exist, Wilberg often has a view, but her approach is not to pick a side and decry the opposite. When Supreme Court decisions are unclear, she explains why directly, but proposes a course forward. Hers is method of reconciling cases, suggesting divisions are more perceived than real, or placing matters on a spectrum rather than into camps. In less skilful hands this could be serial demurral, but Wilberg is always clear on the underlying principle. The result is a picture of administrative law especially attuned to New Zealand judgery in the 2020s. That is precisely what will make the text so valuable to modern administrative law practitioners and, I have no doubt, judges themselves.

Two other features of the sources Wilberg draws on reinforce how modern the text is. First, extremely discerning footnotes that often cite only a single recent case of high authority. It leaves no doubt it is a book about administrative law for today. Second, it is a text that serves as a sort of reef for modern New Zealand administrative law scholars. The footnotes are full of Knight, Clark, Geiringer, McLean and many, many more. It does not shirk on the classics – both from New Zealand and overseas. But it is particularly generous in its attribution of ideas and highlighting modern New Zealand scholarship. Readers will benefit not just from Wilberg’s own deep thinking, but also from being reminded (or even introduced to) classics of New Zealand administrative law scholarship.

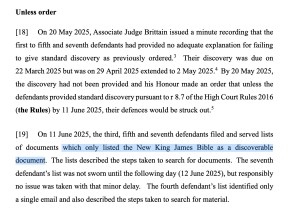

Part Five of the text landed less strongly for me. It is about Administrative Justice – subject-specific systems of decision-making and remedial regimes short of judicial review (for example in immigration or social security decision-making). By design, the text moves away from judicial review and instead talks about features of administrative justice systems in New Zealand. The focus is largely on the architecture of different systems rather than substantive law. While it uses plenty of examples, it is talking about a topic that focuses on design of legal systems rather than the law itself: things like how rights are protected, what levels of representation are permitted, or what appeal or review rights are conferred. It is not a criticism to say these topics are more abstract, though Wilberg does try to convince practitioners that how other dispute mechanisms work will be relevant to the question of when judicial review will and will not be entertained. Despite that it is still a disjoint from the intensely practical chapters in the earlier parts and will be more relevant to policy makers or those studying administrative justice than it will be to practitioners or judges.

That said, in Part Five, Wilberg is not intending to give us the latest word in judicial review, but rather a much earlier word in administrative justice – at least in terms of an account in a New Zealand text. That is borne out by the footnotes which draw more heavily on overseas academic work than the more scant New Zealand sources. Wilberg’s generosity in the earlier parts is giving us her account of a well-trodden area. Her generosity in Part Five is giving us a foundation for further administrative justice scholarship in New Zealand.

I pre-ordered this book well before I was asked to review it because I wanted to know what a new text in administrative law would have to say. In the couple of months that I have had it, I have used it often and felt like I had a secret weapon. It is now the first text I consult. It is a matter of time before it is regularly cited in judgments.

At a time when we needed a new administrative law textbook, New Zealand is very lucky to have received this.

—

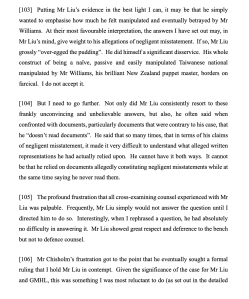

[1] If you don’t want to ask a slogger in the profession like me, you could read the foreword which is by Peter Cane and offers considerably more erudite analysis of Wilberg’s work.